is car loan interest tax deductible 2019

Business owners and self-employed individuals. The loan itself isnt.

On Is Student Loan Interest Tax Deductible R Personalfinancecanada

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax. Ad Search for Car For Tax Deduction and Save Time with HelpfulTips. The same is true if you take out the loan to purchase stock or another investment vehicle.

Why sign in to the Community. The benefit Section 80EEB can be claimed by individuals only. You cannot deduct the actual car operating costs if you choose the.

Click on Edit to the right of the business name. Here are a few of the most common tax write-offs that you can deduct from your taxable income in 2019. Search Find Updated Car For Tax Deduction Right Now at HelpfulTips.

As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit. Unfortunately car loan interest isnt deductible for all taxpayers. If youre a homeowner.

Interest on car loans may be deductible if you use the car to help you earn income. Sign in to the Community or Sign in to TurboTax and start working on your taxes. Experts agree that auto loan interest charges arent inherently deductible.

To the right of the Vehicle expenses click Edit. Any interest you earn on that money while you wait is taxable. Interest on loans is deductible under CRA-approved allowable motor vehicle.

Heather determines the motor vehicle expenses she can deduct in her 2021 fiscal. This means that if you pay 1000. 10 Interest on Car Loan 10 of Rs.

Under Your income click on EditAdd to the right of Self-employment income. Should you use your car for work and youre an employee you cant write off any of the interest you pay on your. Is car loan interest tax-deductible.

Any interest you earn on. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. The tax deduction is only available for the interest component of the loan and not for the principal amount.

An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 15 lacs us 80EEB. This is why you need to list your vehicle as a business expense if you wish to deduct the interest. Interest on loan to buy vehicle 2200.

Updated Can I Deduct My Business Related Auto Expenses On My S Corp Taxes

Is A Car Loan Interest Tax Deductible Mileiq

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage

Can A Personal Auto Loan Be Tax Deductible

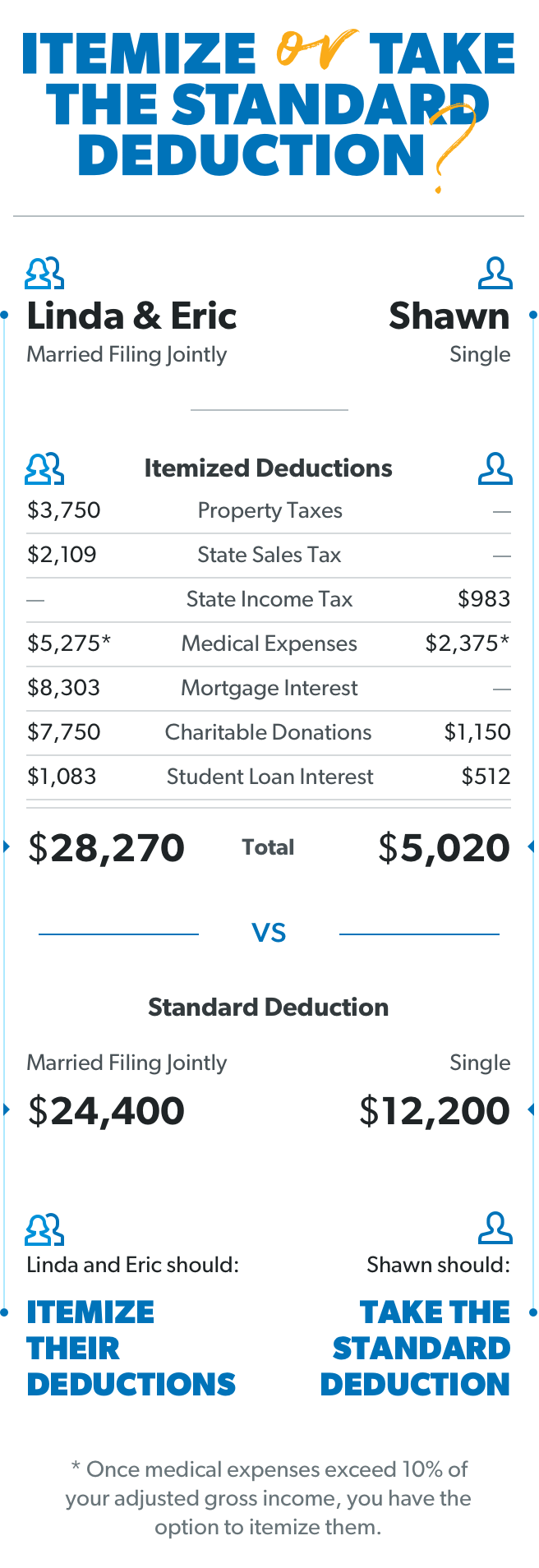

What Is A Tax Deduction And How Does It Work Ramsey

80eeb Of Income Tax Act For Deduction Of Interest On Electric Vehicle Loan

Solved Problem 5 23 Interest Lo 5 8 Ken Paid The Following Chegg Com

Can The Student Loan Interest Deduction Help You Citizens

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

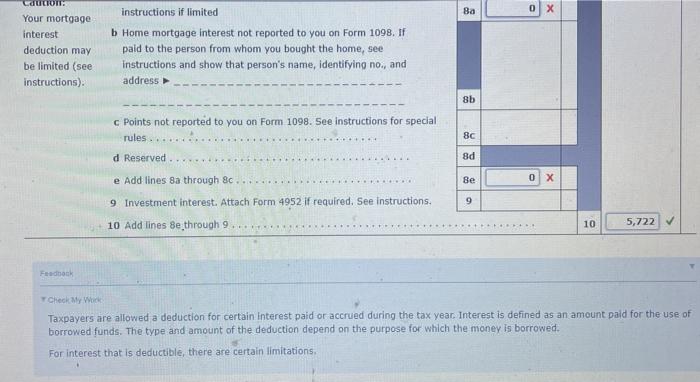

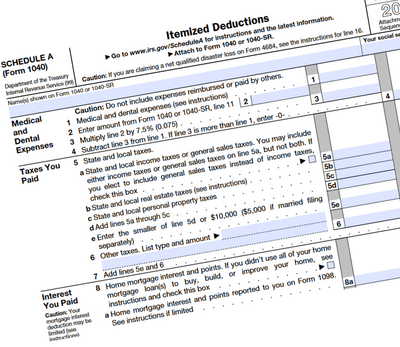

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

Is Credit Card Interest Tax Deductible Rules And Exceptions To Know

1040 Schedule 1 Drake18 And Drake19 Schedule1

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos

Vehicle Sales Tax Deduction H R Block

How To Maximize Your Mortgage Interest Deduction Forbes Advisor